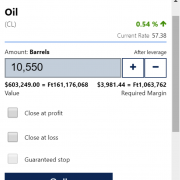

Buy and Sell Oil (CFD) On Plus 500: A Guided Tutorial

When you buy and sell oil (CFD) , you are increasing your ability to grow wealth (if done incorrectly, you can lose your money too). This tutorial will teach you how to utilize Plus 500, a reliable online CFD broker where you can trade stocks, commodities, EFTS, forex, and cryptocurrencies. Oil and gas powers virtually […]