CFD trading setup in three simple steps..

CFD Trading Setup

Hi all,

A month ago James84 posted a question on the cfd tutorial: How to make money on CFD. His question was if I could give a detailed example of that lesson. In that lesson I explained the three steps that is needed to make money on CFD trading. In this blog I am going to talk about a CFD trading setup.The first step was to choose a good CFD broker. If you want to know on how you can recognize a good CFD Broker then read this article: CFD broker, how to recognize a good one. Step 2 is all about the CFD trading setup and Step 3 was all about how you should always protect yourself from the downsize.

On our website there is a section where you read reviews of brokers. You find that section by clicking here: Compare brokers. Our review are conducted carefully and we have test it ourselves. At some brokers we have a trading account as well. Let’s move over to the CFD trading setup.

CFD trading setup step 1

The first thing that I always do when I am setting up my CFD trading is always to check what the conditions are. What is the current trend of this stock, forex or commodities. Is it going up? Downwards? Or is it just going sideways? Example GBP/AUD:

In this example I use CFD trading setup on the currency pair GBP/AUD. As you can see the current price in the chart is 2.08298. I first drew the trend lines to determine the trend. At the current situation the forex pair GBP/AUD is in a downtrend. So in this case I go short on the currency GBP/AUD. With the help of the Fibonacci and the trend line I can estimated at which price the downtrend will probably end.

CFD trading setup step 2

Step 2 is all about checking if the are any news or important events on the agenda that might change the course of the GBP/AUD. For example the meeting result of the central bank, new economic data, these two things can have a huge impact on the forex pair GBP/AUD.

CFD trading setup step 3

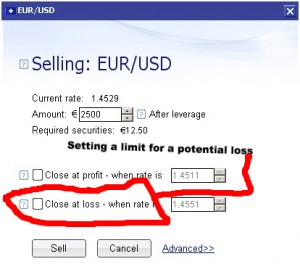

After completing step 1 and step 2. I will go short if step 2 points out that there are no news or any events that can influence the way the GBP/AUD is currently moving towards to. In step 3 I will put in at my Plus500 account the prize that I would love to enter and I would fill in the prize of the stoploss order to minimize my loss. No matter what my stoploss price is always 10% of my investment. So this way if something went wrong I will never lose more then 10% of my investment for this trade.

By following these three steps. I gain huge and lose a little. Eventually if the price movement go to the direction that you have predicted, you can move up your stop loss order and this way you will be protecting your profit.

I hope this blog answered your question James84. Sorry for the delay but I was quite busy. If you any questions regarding this blog then feel free to post your questions in the comment section below. Have succesfull trades all.

Read more about CFD Trading: How to make money with CFD Trading